It was a long and hot summer in my neck of the woods, which fortunately was periodically interrupted by the occasional downpour and cloudy day.

But now that it’s October, it won’t be long before we’re donning our winter coats, and for my generation, our galoshes. This is also the time when many companies in the winter sports and apparel industries gear up for the final sales push of their products for the winter season, which extends from October through the end of March.

For credit managers who work in these seasonal industries, one of the most important ideas I would like to propose is that rather than using a DSO number for the whole year, I believe it would be more accurate to use a seasonal DSO, thus referring to it as SDSO.

Just as a quick review — DSO is a measure of the average number of days that it takes a company to collect payment for a credit sale. DSO can be determined on a monthly, quarterly, or annual basis.

To compute DSO, we divide the average accounts receivable during a given period by the total value of credit sales during the same period and multiply the result by the number of days in the period being measured.

Simply put: DSO = (Average Accounts Receivable / Total Credit Sales) / Number of Days in the given period

Given the vital importance of cash flow in running a business, it is in a company’s best interest to collect its outstanding accounts receivables as quickly as possible. Companies can expect with a relative amount of certainty that they will, in fact, be paid for most of their receivables. But in view of the time value of money, the time spent waiting to be paid is money the company may have to borrow to sustain its operation.

Generally speaking, a high DSO number shows that a company is waiting a long time to collect their money. This can lead to cash flow problems, and if severe enough, can bring a company’s operation to a halt. Conversely, a low DSO value means that it takes a company fewer days to collect its accounts receivable, which can greatly help to support its operation and grow its business.

In effect, determining the average length of time that a company’s outstanding balances are carried in receivables can reveal a great deal about the nature of the company’s cash flow.

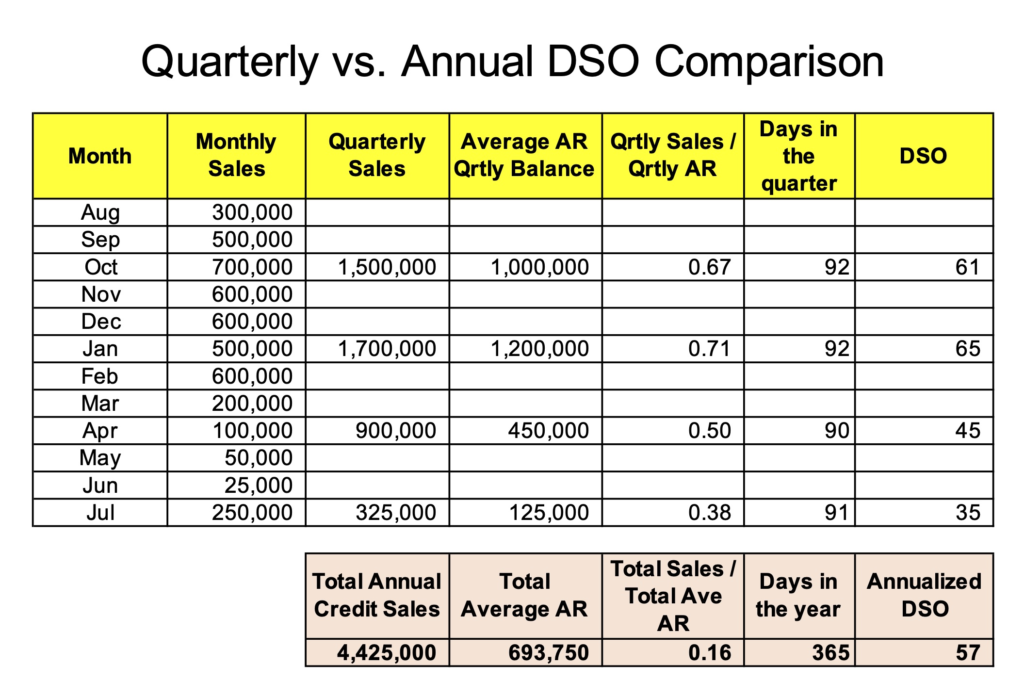

Following below is a table that reflects the sales and accounts receivables of a winter sporting goods manufacturer which sells its products to distributors. Although the distributors will resell the products to their retailer customers on credit, payments are often delayed until the winter season is over.

At the bottom of this table, the DSO has been computed over a one-year period by taking the total annual credit sales, dividing it by the average A/R, and then multiplying that result by 365 days. As you will note, the annualized DSO is 57 days, which in my view is misleading.

The reason that this DSO doesn’t work well is because we can see that in the period from August – October, the DSO is 61 days and from November – January, the DSO has increased to 65 days. Subsequently, we have a very large decrease in the DSO for the period February – April to 46 days, and finally ending up with a DSO of 35 days for the period May – July.

In other words, it’s not until after the winter season is over and well into summer that the distributors have finally collected their A/R, and in turn have been able to remit to the manufacturer.

If we look at the quarterly seasonal DSO, we can see that from August to the end of January, it’s going to take the manufacturer at least two months to collect its receivables. Other than the reason that the industry has a seasonal cash flow bottle neck, we should be asking ourselves if there are any strategies or tools that could be implemented to shore up this cash flow disparity?

For example:

Would factoring the seasonal receivable be an option – Up until a few months ago, factoring receivables was very cost effective. However, with the recent benchmark interest rate hikes by the Federal Reserve, factoring fees and rates have also increased. That said, if gross profits are large enough to accommodate the factoring rates and fees, then this could be a viable option.

Are cash (early pay) discounts feasible – For very good distributors, especially for those who normally pay on time and purchase a great deal of product, offering them a small cash discount could greatly increase cash flow and reduce the DSO during the longer DSO periods.

Can credit cards be used for smaller sales amounts – Pulling out smaller cash sales from the credit sales and A/R balances could reduce DSO. More and more companies are using corporate credit cards to pay for their purchases. If they pay on time, there are no interest fees incurred and at the same time, the purchasing points can greatly add up to offset other purchases.

The Bottom Line

In many businesses, the days sales outstanding number can be a valuable indicator of the efficiency of the business and the quality of its cash flow. However, like many other financial ratios and indices, getting into the details, and making adjustments is important to clearly understanding how these figures will impact your business.

Your questions and comments are most welcome (nseiverd@cmiweb.com).

Nancy Seiverd, President, CMI Credit Mediators, Inc.